If you want a great forex trading approach you can always use the Swing. It is very suitable for binary options such as stocks, indices, commodities, and currency pairs. There are many forms of trading that you can learn but if you want to be more profitable then you need to learn something that is advance is efficient. The Swing 15 Minute Technicals can help you with your advance trading needs. This system established on resistant and support breakouts on fifteen minute charts making it ideal for every day trading. This system is very well detailed and can be very simple for expert traders to follow. Signals can be taken from charts with fifteen candlesticks that have either resistance or support lines on longer term charts. Primarily made for British and Euro controlled currency pairs, the Swing can work at any market that is liquid.

KNOWING MORE ABOUT THE SWING 15 MINUTE STRATEGY

The Swing can be divided to four different sections. Each section details different trade aspects. The strategies first section shows how to take signals and where to take them. The next section show to you can size positions. The third section shows profits targets which are a fact that is not so vital for binary options traders but is vital for forex traders. The last section shows tips on to deploy it and some probable trade factors.

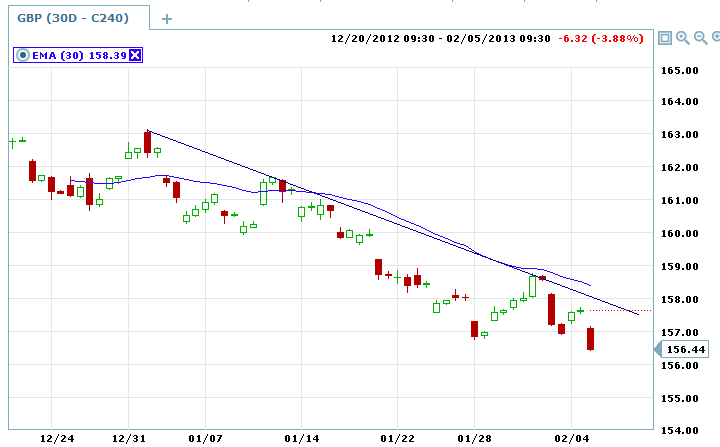

The strategy’s author, Olivier, shows how you trade and what you trade. In this strategy, he trades shorter term breakouts of resistance and support. You can locate these support and resistance zones by using three varied time frames. You may use a four hour candle chart. If you cannot create a four hour candle chart you can opt to use a half day bar or daily bars if the need arises. This sets up support and resistance and primary trend. To ensure that the lines you are drawing are significant make sure to connect three points the least. When this is done, you go down to the hourly candle charts and repeat the step. To do away with confusion, you may use different colors for different time frames. This allows you to recognize what lines are more vital when you drop to 15 minutes bars in the chart. Once your charts are done all you can do now is wait for a single signal. You must do this prior to the trading day’s start so that when the market opens you. Let us take a look at chart which shows us the downtrend which connects through three peaks:

Signals appear if there is a breakout below or above a resistance or a support. Breakouts depend on a close that is either above or below a selected line. A simple line break without a close has to be deemed as a false signal or a whipsaw until it is completed by a close below or above. when there is a close you can now open a position. Open puts for breaks that are below the trend or support. Open calls for breaks just above the trend or support.

The first part of the strategy deals with position sizing and risks and rewards. This part can be linked to position sizing in equity options and is thereby useful for binary options too. The author proposes position size to be a specific percent of your capital which is around one and a half percent. Using this approach, you can limit your losses to good amounts and your trade sizes will also increase as your account also increases.

The third step entails profit targets. For the author, targets are for position additions and for profit taking depending on the trade’s progress. Binary traders can find this useful in identifying if the trade is in a daily or hourly position. When applying this to binary, you must put in mind that the closer the target is to the point of entry, expiration time is also shorter. When target appear on fifteen minute charts you may use hourly or even shorter time.

The last section shows some guides and tips on how to use the strategy. The author begins with the trends assumption and then a subjective support and resistance. This is basically true. There are many ways to identify these areas. These ways don’t correspond with each other. The author also suggests that you should not trade on days with big news or on a quiet market because they are not good days.

WHY IS THE SWING GOOD?

This strategy is good because it makes use of some typical form of trading and offers necessary targets for profits and targets. It does not suck because it makes use of multiple time frame swhich is the basis for most strategies that are successful. This strategy may be predestined for forex but it can be used for binary options.

WHY IS THE SWING BAD?

It is not good because novices can benefit from it. It is quite complicated and only seasoned professionals may fully benefit from it. As mentioned before resistance and support are very subjective and trends are very subjective. You can only utilize them well when you are already experienced.