To make it in this business you do not really need a degree in economics or to be super smart mathematician. Its just to get knowledge and to follow rules. If you are able to do that, then you have good option to succeed. All trading world depends on simple supply and demand as all business world as well. I am sure you know what that means but lets take a look at simple example in practice to make it more familiar and understandable.

What you will learn in this article:

- What are charts?

- How many types of charts exist?

- How to use them for your benefit!

- Where to read charts?

- What is analysis?

- What types of analysis exist?

If we go back to the example i mentioned, let us think of high-end whiskey brand where supply of them is low because there is only one manufacturer and it takes them years to put the product on the shelves for the public to buy it. On the other side, we have apple fruit where supply is high since there is many people out there that is growing and providing them.

Now, if we take a look and focus at the price, if supply of one thing is low that means the price is high since there is more demand for such product and if there is a lot of supply as we said with apples, then the prices are lower. That is also how financial industry works, based on supply and demand, only thing different is they don’t use apples and whiskey but financial products.

CHARTS

All the assets can be shown on a chart that’s why you can not trade without one. Its a graphical presentation of chosen asset with a defined period of time. If you did not know, there is many different types of charts out there but only one i would recommend are candlesticks. This type of chart provides us with the most info on the asset and gives us better insight on how it performs. Based on the charts we can see the past performance of one asset in certain period of time and based on that and also fundamental analysis we can predict where the price will go next.

WHAT TYPE OF CHARTS EXIST?

We have 4 different types of charts that traders and investors use to get their information. They are called: bar chart, line chart, candlestick chart and point&figure chart.

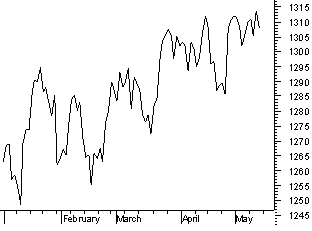

LINE CHART

This one is really basic and as the name suggest you can already presume its a line and it represents closing prices of asset through period of time. To get the line you basically connect the dots of closing prices. Since the most considered and important is the closing price some use this chart to get the idea on where the asset will go but there is no other information available such as opening prices and high/low.

BAR CHART

Bar chart is an upgrade to the line chart since it gives us more information. As you can see it is made of lines that are vertical and each of them represent a point with information which is high and low for this period and you also get to know at what price it has closed. opening and closing can be seen by horizontal line or dash on it. Opening price is located on the left side since we are going from left to the right, so the closing price is on the right side.

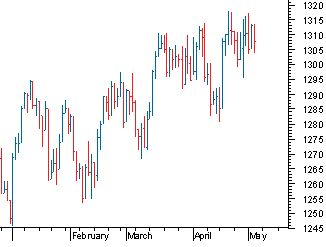

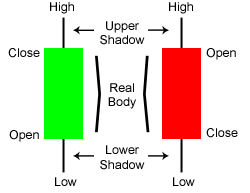

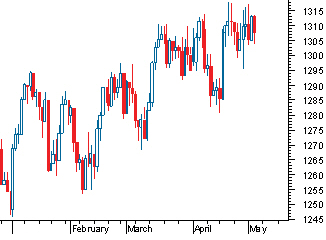

CANDLESTICK CHART – RECOMMENDED OPTION!

This chart is similar to bar chart, only difference is the structure of it since it is visually different. We also have thin vertical line in candlestick charts which represents certain period range. But then we have a bigger body, wider on this same vertical line which illustrates the open and close of this time period that candlestick represent. Another thing is that when its going up its different color then when its going down. You can see that here:

and next take a look at how it looks in a chart as a whole:

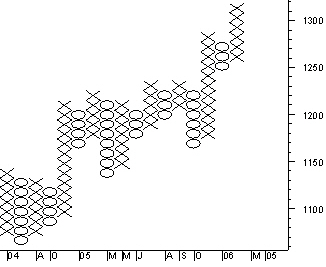

POINT&FIGURE CHART

This is not very well known chart and most traders and investors do not use it. We will just cover it so you are aware of it. As you can see it represents from X-s and O-s. It is simple since X represent the trend of the price that is moving upwards and O represents the trend of the price that is going down.

WHERE TO READ CHARTS?

METATRADER 4. This is one of the best source for free charting info. You should download the software and connect it with one of the best forex brokers so thy send you right info and choose one that has a lot of options in it so you get all the info needed. http://www.metatrader4.com/

MULTICHARTS. This is also downloadable product that gives you high quality charts. Visit here: http://www.multicharts.com/

FREE STOCK CHARTS. You do not need much info on this one, i suggest you visit it here: http://www.freestockcharts.com/

ANALYSIS

What is analysis? With this, you analyse the potential trade. It is a must before trade, otherwise you can lose all the money you have. Of course you can complicate things, but as they say, simple is the best also applies here. Everyone has their own strategy but since you are a beginner i would recommend following the trend and make analysis based on that.

FUNDAMENTAL ANALYSIS

This means you get and study the info that is provided from different news sources which affect the movement of the price of a certain asset. May be, there are some changes in European bank system or there are some problems or someone is taking legal actions against company. This all, takes the price up or down. That is why this analysis is important when trading.

TECHNICAL ANALYSIS

Here you apply your own terms and strategies on where the price should go. You can use indicators, different type of charts, different time frames. Here you have no limit since people have different methods. You want to predict in which way in certain time frame the asset will move based on information from the past. That is why it is good if you use both of analysis together to determine.

FINAL PARTS

Now you have more clear vision how the whole market in finance works and that with little knowledge and analysis you increase your chance of profits and success in long-term. Also, do not forget, to not over-trade, only trade when you have facts in place and you are sure of the trade.