ITRADER.com Review

ITRADER

Details

| Broker | ITRADER |

|---|---|

| Website URL | https://www.itrader.com/ |

| Founded | 2013 |

| Headquarters | Grosvenor Tower, Griva Digeni & Kolonakiou 125, Ground Floor, Linopetra 3107 Limassol, Cyprus |

| Support Number | +80040015002 |

| Support Types | phone , fax , email |

| Languages | 9 languages supported |

| Trading Platform | MT4 web, MT34 desktop, MT4 Mac, mobile apps |

| Minimum 1st Deposit | 0-250 |

| Minimum Account Size | $0 |

| Bonus | No bonus |

| Leverage | up to 1:400 |

| Free Demo Account |

|

| Regulated |

|

| Regulation | Regulated by CySEC |

| Deposit Methods | credit/debit card , wire transfer , Skrill , WebMoney , others |

| Withdrawal Methods | credit/debit card , wire transfer , Skrill , WebMoney , others |

| Number of Assets | 750+ |

| Types of Assets | cryptocurrencies, forex, indices, shares, and commodities |

| US Traders Allowed | |

| Mobile Trading |

|

| Tablet Trading |

|

| Overall Score | 55 |

Pros

- Compliant with the European regulation, including MiFID II and licensed by CySEC.

- Wide range of CFDs offered, from forex, indices, and shares, to commodities and cryptocurrencies.

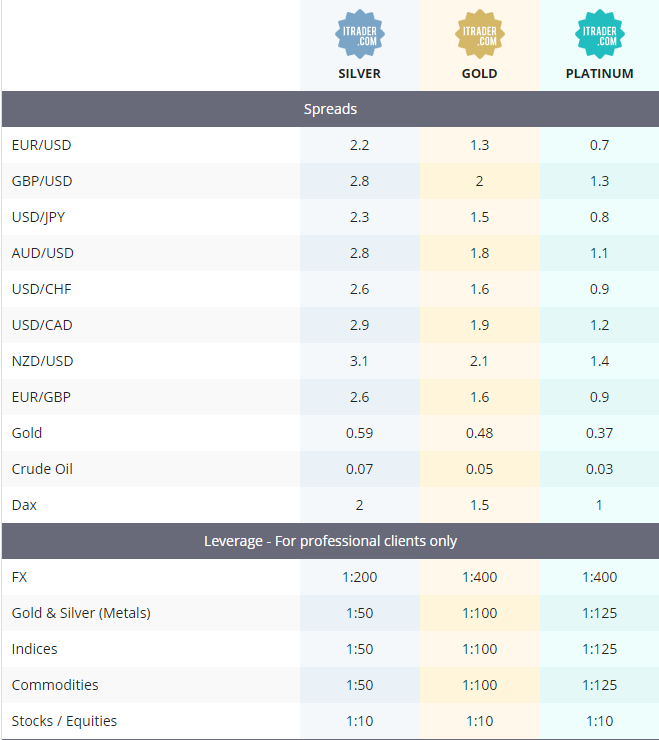

- Maximum leverage of 1:400.

Cons

- Ambiguous information provided on the official website.

- Most-likely a market maker which means a huge conflict of interest.

- Old and outdated trading features, with no updates made in years for the trading platform.

Regulation

Hoch Capital LTD, the owner of ITRADER.com, is authorized by CySEC under license number 198/13, granted on May 13th, 2013. At the same time, since we are talking about a regulated firm in Cyprus, an EU member state, the company is subject to cross-border regulation by all regulators inside the EU. Full compliance with the Markets in Financial Instruments Directive 2014/65.EU or MiFID II is ensured, as well as the EU’s 4th Anti-Money Laundering Directive.

It’s still hard to understand why the broker did not try to get licenses from other European regulators like the FCA or BaFIN. After 7 years of existence, it would have communicated a strong commitment to ensuring the strongest regulatory compliance. Are there any other questionable aspects of this broker? Read the entire review to find the answer.

Trading Platform

ITRADER continues to be an advocate of the MetaTrader 4 platform by MetaQuotes. The platform had long been the most popular trading software and continues to be trending around experienced traders. It provides access to multiple charting, a wide range of technical indicators, and the ability to build or use pre-existing Expert Advisors. Automation in the trading industry continues to advance, but it does not seem ITRADER managed to make any advancement when it comes to upgrading the platform.

Right now, clients can trade using the browser or desktop version of MT4. The sole difference between them is that the first one is available via any modern browser. Traders who would like to see proprietary software would be disappointed by the offer currently in place. We should not forget the Mac version of MT4, but it’s not enough to stay in line with what other CFD brokers are currently offering.

There’s also a mobile app available at ITRADER.com, compatible with Android. The company claims to have a version for iOS, but in reality for iOS is the MetaTrader 4 app. As we’ll see in the following sections, other details are misleading as well, a fact that does not build any confidence in the long run.

Account Types

What are the requirements to open a silver, gold, or platinum account with ITRADER? We did not manage to find the answer to the question, and it should be concerning for potential clients. We did manage to find that the minimum deposit is $250, and traders can use credit/debit cards as well as wire transfers.

Among the services provided, news alerts (which are provided by MetaQuotes, not ITRADER), free VPS, dedicated account manager, webinars $videos, hedging, and swap discounts are a few of them. Silver account holders are not benefiting from some of them. Islamic accounts for clients of the Islamic faith as well as retail/professional trading conditions are currently provided, given compliance with the EU regulation.

The company does provide coverage for CFDs on forex, indices, commodities, shares, and cryptocurrencies, but we don’t manage to understand some of the trading features. Gold and Platinum account holders receive swap discounts of 25% or 50%, respectively. But how the company is able to give back that amount is not described on the official website.

Promotions

Due to the compliance with European regulation, ITRADER’s ability to provide trading promotions is limited, especially to retail traders. The company does have an introducing broker program, allowing clients or anybody else to become an affiliate. For more information about the affiliate program, you can visit the broker’s website.

Educational Material

The ITRADER.com Education Center provides access to webinars, eBooks, V.O.D., courses, tutorials, and various news articles, among others. It could be good news for beginners who still have to learn the most basic terms and procedures, but for traders who already have enough experience, the volume of educational resources is very reduced.

At first glance, eBooks are just a few pages each and the information included is scarce. If the company wants to create an image of abundant educational content, the reality is different. This just adds up to the entire series of questionable aspects we’ve found about ITRADER.com

Taking that into consideration, we believe there are much better options available in terms of CFD providers. ITRADER.com fails to deliver enough reasons to convince us trading with them will be reliable.

Visit Broker