TradInvestor

TradInvestor

Details

| Broker | TradInvestor |

|---|---|

| Website URL | https://www.tradinvestor.com |

| Founded | 2018 |

| Headquarters | unknown |

| Support Number | not provided |

| Support Types | email , phone |

| Languages | English |

| Trading Platform | web platform |

| Minimum 1st Deposit | 2,500€ |

| Minimum Account Size | 2,500€ |

| Minimum Trade Amount | 0.01 |

| Maximum Trade Amount | different for each instrument type |

| Bonus | Deposit bonus |

| Leverage | not mentioned |

| Spread | fixed/floating |

| Free Demo Account | |

| Fees |

|

| Deposit Methods | bank transfer , credit card , e-wallet |

| Withdrawal Methods | bank transfer , credit card , e-wallet |

| Number of Assets | 100+ |

| Types of Assets | forex, cryptocurrencies, commodities, stocks, indices |

| US Traders Allowed | |

| Overall Score | 36 |

Trading Platforms

TradInvestor relies on a web-based browser, that from our point of view is one of the most modest platforms we’ve ever seen. The company had implemented TradingView charts and other than this, there’s little we can say about the trading software.

No mobile app, compatible with either Android or iOS devices, is provided, meaning mobile trading will be conducted via a browser. TradInvestor claims to have developed a user-friendly interface, so even people with no experience will be able to trade with it, but overall, the platform lacks features and lags behind most of the popular brokerage companies.

Regulation

What rings alarm bells is that there’s no single mention to regulation or any regulatory body that oversees the TradInvestor’s activity. We expected to find at least some information about the company that owns or operated the trading platform, but no mention about that on the website. Reading the terms and conditions, we’ve found that the regulatory framework from Bulgaria applies to the company, which means that could be their headquarters.

However, there’s no clear information on the subject added on the website, communicating TradInvestor lacks transparency.

Account Types

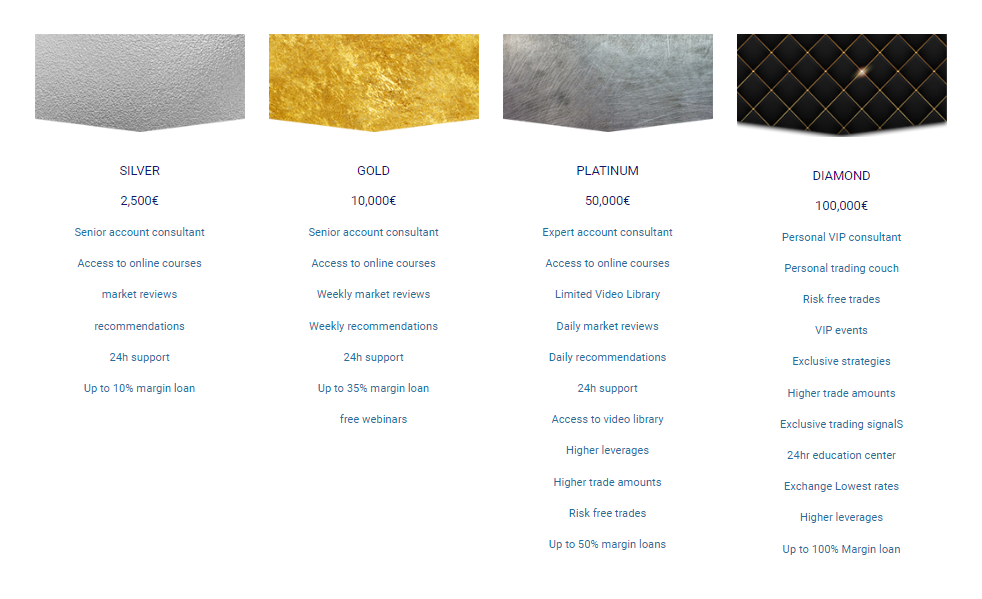

If the lack of regulation was not enough, things get even worse when it comes to trading accounts. The company wants any person who opens an account to deposit €2,500 for a silver account, the smallest included in their offer.

Compared to the industry, this claim is exaggerated, with most of the popular brokers claiming much smaller deposits for live accounts, and unlike TradInvestor, they do offer a bigger pack of features. The deposit requirements go through the roof when it comes to gold, platinum, and diamond accounts, with very weird features like “risk-free trades” and “exclusive trading signals” included. We can’t find any way to open a demo account in order to test their trading services, which means that anyone wanting to do that, has to open a real account and make a substantial deposit.

Promotions

Based on the information provided on the TradInvestor website, there is a deposit bonus available, but the terms are really vague. No actual amount is mentioned and trading volume requirements are missing. You should carefully read the information yourself and document seriously before deciding to open a real account.

Pros and Cons

- TradingView charts integrated into the platform.

- A wide variety of technical tools available.

- No information regarding regulation.

- High deposit requirements.

- Very high withdrawal fees.

- Basic trading platform with limited features.

- Little information on the company’s background.

Educational Material

Without opening a real account, we see that the Education section on the website has information about forex and cryptocurrencies. Yet, there’s nothing useful that can help any trader to learn new skills. We can only see basic information that can’t be applied to any trading strategy. The company claims that clients get access to online courses, but we don’t actually know whether additional educational material is provided for someone who opens a real account.

Visit Broker