The Swiss proverb says, “ Greed is the most dangerous emotion.” This is very true for most traders. It is an undeniable fact that a lot of traders have suffered a lot due to greed. This is actually were the famous trading saying “Bulls and Bears make Money and Hogs get slaughtered” came from. Hogs are the greediest of the animals an in trading there is no mercy for traders who embodies hogs. Because of the risk for people falling into the pit of greed, it is pretty much ideal to understand what it truly is.

WHAT IS GREED?

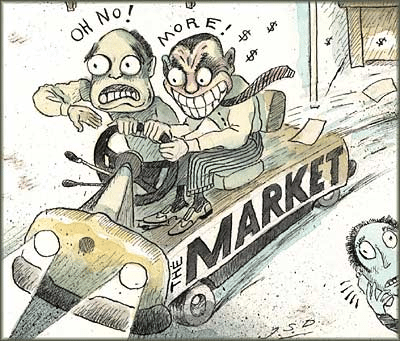

Common dictionaries describe greed as a selfish and extreme longing for more of anything (including money) than what is needed or necessary. This sounds familiar right? Yes, many of us are guilty of being greedy. It is our longing to get more returns that push us to trade and such desire is no longer healthy and then become dangerous when done excessively. This is why it is often deemed as a very dangerous emotion for anyone involved with trading. This is considered as something worse than fear. Fear paralyzes you and keeps you away from trading however; you still have your capital preserved just as long as your hands are in your pocket. On the contrary, greed lures you towards acting in times and even in ways that are not good. This is why greed is dangerous.

WHAT ARE DANGERS OF GREED?

Greed can let you act in an irrational way. As a trading greed may come on various ways including, overtrading, market chasing, and over leveraging. These are things that you should exit once you know it is happening to you already. As a matter of fact, greed is similar to alcohol and drugs. It allows you to do foolish things especially when you have too much already. When greed has already clouded trading judgment, it is then that you are drunk with it.

HOW TO OVERCOME IT?

Just like other necessary gestures, conquering greed needs more discipline and effort. It is not that easy but overcoming it is possible. It’s just about how to tame the ego. You need to accept your fault and admit that every call is not always right. There are times when you cannot grasp the full move of the market. There are also times when you will miss out on a good set up.

FINALE

This is how trading is. The moment you learn how to accept that you are smaller than the market and that you will surely commit errors, it is by then that you can be more focused on following your plans and not submitting to greed. Many successful traders believe that it is better to be lucky rather than simply be good. For these traders, it is better to depend on luck rather than trust on their capabilities. This is not good for the ego, but it is great for the trading psyche. Don’t let trading be a blame game because of greed but rather make it a thinking an analysis game.