This week the situation turned on the upside, as the Irma hurricane had passed and there have been diminishing tensions between the US and North Korea. In terms of US dollar index binary options activity, the price had been trading upwards, covering some of last week losses.

Current price structure points for further gains

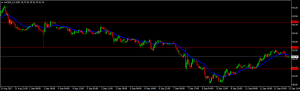

Looking at our chart below, you can see that the price had been trading impulsively since Monday open. Interestingly though, the gap that formed at the open had not been filled, as usually happens, confirming that the bulls were eager to continue to buy.

To refer a little about the technical analysis, if the upside trend will continue higher, we expect selling pressure to emerge around 92.03 and 92.78, were binary options activity on the downside could resume again.

A retracement lower, on the other side could send the price towards 91.41 swing point, where buying activity could emerge again.

A downward leg is expected before a continuation higher, since the price had been trading lower for a decent amount of time and from a technical perspective, V-shape bottoms occur very rare.

The political situation could play a major key in the future. A UN meeting scheduled for a new round of sanctions against North Korea could revive the downward pressure and the bearish trend could resume. The recent surge in price had been driven by a calm situation in North Korea as the communist regime did not made any significant statements in recent days. In case the UN will decide to add new sanctions, they could respond to them and tensions could arise again.

To sum up, current upside leg had formed due to a relief of the tensions that had been high for a decent amount of time. However, the risks to the downside persist and any new surge of political risks can have a bearish effect on the US dollar index.

Risk Warning and Disclaimer

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. No information or opinion contained on this site should be taken as a solicitation or offer to buy or sell any currency, equity or other financial instruments or services. Past performance is no indication or guarantee of future performance.